© Reuters.

By Nell Mackenzie

LONDON (Reuters) – An investment vehicle managed by hedge fund Brevan Howard delivered a successful 2022 on a surge in global borrowing costs, an investor presentation seen by Reuters showed.

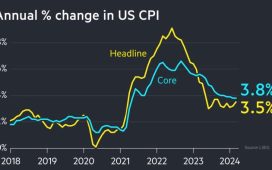

Most financial markets were roiled last year by the most aggressive pace of rate hikes from central banks such as the U.S. Federal Reserve in decades to contain surging inflation.

Market volatility helped BH Macro, a publicly listed feeder to the master fund of Brevan Howard Capital Management, to a 21.93% performance last year in the sterling denominated share class, the presentation showed.

That marked the third best year since its 2007 inception, according to the presentation shown to investors this week.

Brevan Howard Capital Management declined to comment.

Interest rate trading, which gave BH Macro most of its profit rise, included bets on U.S. interest rates and positions related to inflation, volatility and European rates.

BH Macro also saw a small benefit from its foreign exchange trading positions, the presentation showed.

Less than 4% of losses were taken in the other parts of the market BH Macro was involved in, notably stocks, commodities, credit and cryptocurrencies, it also showed.

BH Macro, which has assets worth 1.4 billion pounds ($1.74 billion) and is listed on the London Stock Exchange, has seen positive returns after one of its only two down years in 2017, when it had a negative 4% return.

Like other hedge funds which trade on macroeconomic factors, the BH Macro investment vehicle does well in volatile markets.

Its best year was in 2020, with a 28% return.

Last year was a positive one for macro style hedge funds, which HFR’s (Hedge Fund Research) index says returned almost 9%.

However, this sector of the hedge fund industry saw $15 billion of investor outflows, despite it being one of the best performing sectors, the research provider said.

($1 = 0.8067 pounds)