This article is an on-site version of our Unhedged newsletter. Sign up here to get the newsletter sent straight to your inbox every weekday

Good morning. The Unhedged team is back on our feet. A little cold is not enough to make us miss Fed day. Today we’ve taken the vital signs of US consumers, and found them to still be in rude health. That is one of several factors that will keep Jay Powell and his team at the central bank on their toes. Send us your thoughts: robert.armstrong@ft.com and ethan.wu@ft.com.

The US consumer isn’t hunkering down

The lingering pandemic shock makes the US consumer hard to read. To understand what’s happening, two distinctions are crucial: nominal vs real, and goods vs services.

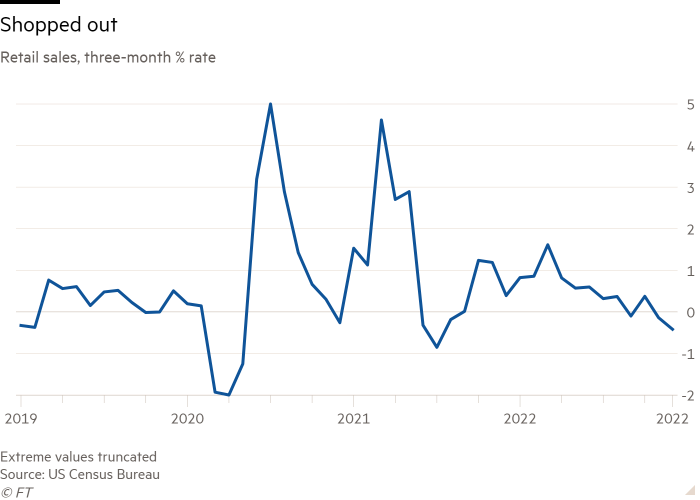

The place where the consumer looks weakest is in goods spending, especially in nominal terms, where deflating prices exaggerate the contraction. Retail sales, a nominal measure of (mostly) goods spending, have shrunk in three of the four past reports:

Behind the recent decline is consumers spending less at petrol stations, furniture depots, car parts dealers and electronics/appliance stores. Other than petrol, where the story is mostly falling prices, this all has that familiar pandemic hangover flavour. You can only buy so many washing machines, and so on.

But there is also evidence of a consumption slowdown on the services side. Nominal services spending (pink line below) still has some pep, even though in real terms services consumption stopped growing in December (light green line). The chart below shows annualised month-over-month growth rates, and we’ve included real and nominal goods spending (blue lines) for contrast. The main point is that everything is slowing or contracting:

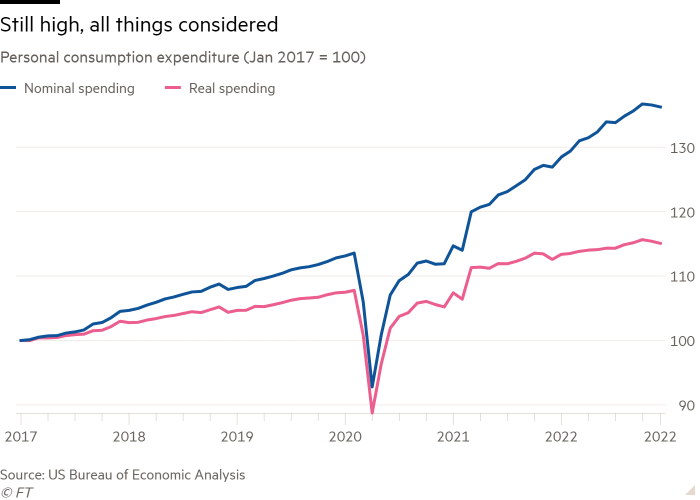

Step back, though, and the recent slowdown looks rather small. Nominal consumption still floats above its pre-pandemic path, and even real spending is bang on trend:

The broad macro picture of the consumer, then, is something like this: spending is slowing a bit in both nominal and real terms, but the slowdown is much faster in goods than services, and the level of nominal spending is still above the long-term trend.

This picture is not a perfect fit with what we have heard to date from corporations’ fourth-quarter earnings reports. The oddest thing is that the big credit card companies, which reported last week, said unanimously and emphatically that they were seeing no change at all in the overall trajectory of spending.

There has of course been a slowdown in payment growth rates relative to 2021, a year where growth was flattered by comparisons to the early days of the pandemic. But indexing spending to pre-pandemic 2019, the trend is rock steady. Here is a chart from Visa, indexing US credit, debit and total payment volumes to the level of three years before. The trend is indeed consistent, and in the first three weeks of January the spending has picked up a bit:

Here is Visa chief financial officer Vasant Prabhu:

Business trends have been remarkably stable . . . there’s no evidence of a change in trend. That’s reflected in our second quarter outlook. At this point, we’re not changing any expectations for the second half . . . What’s happening is as goods spending slowed down a bit, services spending really took up all the slack. And so consumers have just shifted their spending, but they’re spending the same amount.

The story from Mastercard and American Express was almost identical. Mastercard’s CEO noted the combination of low unemployment, higher wages and elevated savings as supporting spending. Here is Mastercard’s volume growth, both year-over year and indexed to 2019. Note again the uptick in the first three weeks of January:

It’s not just the card companies. Lots of consumer-focused companies have reported solid results. McDonald’s saw US sales rise more than 10 per cent, well ahead of inflation. PulteGroup, the homebuilder (and an Unhedged short in the FT stockpicking contest — ouch!) had a strong revenue quarter and said demand increased though the fourth quarter and January. While there have been exceptions (eg, Sherwin-Williams’ soft guidance), the tone among the consumer companies we keep an eye on has been notably positive.

Why don’t the card networks and other consumer companies see the slowdown that is plain in the macro data? Well, card volumes are nominal, and a lot of the increase in spending is driven by inflation. To make this point vivid, consider Procter & Gamble fourth-quarter results — where sales grew by 4.5 per cent but volumes fell by 6 per cent. Their table:

Again, it is important to put the retail sales data to one side, mentally, as they are overwhelmingly goods, whereas cards capture services spending — and for that matter probably capture a lot of business spending, too.

All of that said, though, company results so far have been a good reminder that while US consumers might not be spending quite as exuberantly as a few months ago, they are still spending a lot, probably at a rate above the long-term trend.

The macro- and firm-level spending stories roughly match what we know about consumers’ financial health. The latest employment cost index, released yesterday, shows wage growth coming off the boil, but still simmering. This chart from Jason Furman excludes volatile incentive bonuses to home in on wages and salaries:

Meanwhile, though the stock of pandemic savings is dwindling, a buffer remains. Here, from Matt Klein’s latest newsletter, is where excess savings stand today. He, like most of the analysts we’ve asked, thinks the savings stock should run out later this year (green line shows the trend):

It has been widely noted that the recent easing of financial conditions — in the form of rising stock prices and tightening credit spreads — likely makes the Fed uneasy. It is a de facto loosening of monetary policy. If we are right that consumer spending, despite some recent softening on the margin, is still at or above trend, that is another thing for Powell et al to fret over. A little decline from a very high level may not be consistent with getting inflation all the way to target. The risk that it isn’t may well keep the Fed hawkish. (Armstrong & Wu)

One good read

Janan Ganesh on why conservatives are always behind in the culture wars.