Will the Fed’s rate decision bring it closer to a ‘soft landing’ for the US economy?

The Federal Reserve is widely expected to slow its pace of interest rate increases at its meeting on Tuesday and Wednesday this week, delivering a 0.25 percentage-point increase amid mounting evidence that inflation in the US has begun to cool.

Federal Open Market Committee voters — including the hawkish Christopher Waller — have come out ahead of this week’s meeting in favour of a 0.25 percentage point increase. This raise would mark a return to a more normal tempo of policymaking after the Fed last year delivered four consecutive 0.75 percentage point increases before decelerating to 0.5 percentage points in December.

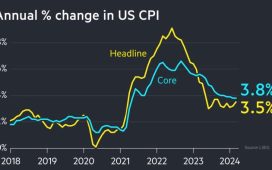

The shift in the Fed’s approach can be attributed in part to the recent chill in inflation. Consumer price growth in December slowed for the sixth straight month, with inflation clocking in at 6.5 per cent. Though inflation remains far from the Fed’s 2 per cent target, December’s level was the lowest since October 2021.

The meeting will also come on the heels of news that the US economy grew more than expected in the fourth quarter — with gross domestic product increasing at an annual rate of 2.9 per cent, compared with the 2.6 per cent forecast by economists. Slower inflation and a better economic outlook mean that the Fed’s hope of engineering a “soft landing” — raising rates enough to stamp out inflation but not enough to push the US into recession — can live on. Kate Duguid

What will the ECB’s rate decision indicate about the future pace of monetary tightening?

Economists largely consider it a “done deal” that the European Central Bank will raise rates by 0.5 percentage points on Thursday at its next monetary policy meeting.

Christine Lagarde, president of the ECB, signalled this month that the bank will “stay the course” of large interest rate increases, suggesting the same half percentage-point increase as at the last meeting which would take the deposit rate to 2.5 per cent up from minus 0.5 in June last year.

With little uncertainty on the rate change, the main point of interest of the ECB meeting will be any messaging about further rates decisions said Andrew Kenningham, chief Europe economist at Capital Economics. “We now think that the resilience of the economy and persistence of core inflation means the Bank will raise the deposit rate by a further [0.5 percentage points] in March and [0.25 percentage points] at the next two meetings, bringing it to a peak of 3.5 per cent,” he added.

But the pace of monetary tightening will depend on the resilience of the eurozone economy and the persistence of high price pressures, with most of the key data being released this week.

Economists polled by Reuters expect GDP data released on Monday to show that the German economy stalled in the fourth quarter of 2022. The same figure for the eurozone — out on Tuesday — is also forecast to show no growth over the same period, confirming a much smaller hit from the surge in energy costs and rising borrowing costs than what was forecast a few months ago.

Analysts also expect eurozone inflation to have eased to 9.1 per cent in January down from 9.2 per cent in the previous month and further below the all time peak of 10.6 per cent recorded in October. Valentina Romei

By how much will the Bank of England lift interest rates?

Markets are pricing in that the Bank of England will raise interest rates by 0.5 percentage points at its meeting on Thursday.

That would take the bank rate to 4 per cent, up from the historical low of 0.1 per cent in late 2021 and the highest since 2008.

“We believe the Monetary Policy Committee will raise the bank rate by [0.5 percentage points] in February in response to stubbornly high services inflation and wage growth,” said Andrew Goodwin, chief UK Economist at Oxford Economics.

Supported by a tight labour market, whereby unemployment levels are relatively low and job vacancies high, UK nominal wages rose at a near record pace in November with private sector pay reaching an annual rate of 7.2 per cent. Headline inflation ticked down in December, but services inflation, a better measure of underlying price pressure, accelerated.

Goodwin added that February’s rise might be followed by a smaller rise in March, “but that should bring the current cycle of rising borrowing costs to a close”.

He also noted that the MPC has avoided tightening less than market expectations in recent meetings and may still be reluctant to take what they perceive as the risk of appearing more dovish than expected.

However, Elizabeth Martins, economist at HSBC, thinks the MPC will go for a quarter of a percentage point rate increase on Thursday. She conceded that there are “significant risks” of a larger rise but noted that “the combination of lower near-term inflation, receding inflation expectations, the rapid slowdown in the housing market and the BoE’s own sub-target, medium-term inflation forecast, mean that the MPC will opt for a slower pace of tightening”. Valentina Romei