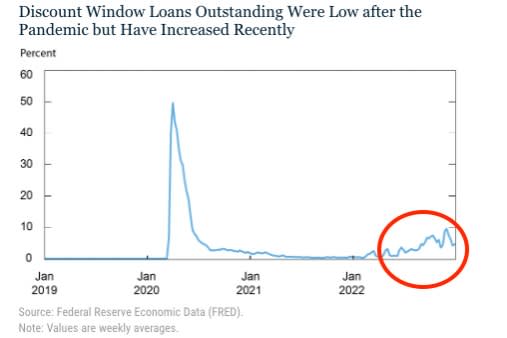

This is interesting: borrowing from the Federal Reserve’s discount window has picked up meaningfully lately.

Clearly, the recent uptick is dwarfed by the Covid-19 spike in 2020 (and by the surge in demand for liquidity at the peak of the financial crisis in 2008) but the shift is still intriguing.

Some background: historically, the Federal Reserve set interest rates by managing the amount of reserves sloshing around the US monetary system. But since 2008 that has been impossible due to the amount of money pumped in through quantitative easing. That forced the Fed to use new tools — with catchy acronyms like IOER and ON-RRP — to raise interest rates in what it has termed the “ample reserve regime”.

It also meant that demand for loans from the Fed’s discount window has been minimal outside of cataclysms like March 2020. Until now. The New York Federal Reserve has therefore published a blog post exploring who and what is behind the increase.

On the first point, say authors Helene Lee and Asani Sarkar, smaller banks are driving it.

On the why, it seems for banks that need more reserves the discount window is now more economical than alternatives such as borrowing from the Federal Home Loan Banks, thanks to measures the Fed has taken to make it easier to tap the discount window. From the post:

The notable decline in the total level of reserves in the banking system this year may have been an important factor for the rise in DW [discount window] borrowing. Indeed, as the Fed has gradually shrunk its balance sheet, the cash balances of smaller institutions, particularly those with total assets less than $10 billion, have in aggregate declined sharply relative to their asset size, reducing their liquidity positions…

…smaller banks are generally more willing to come to the DW than their larger counterparts, as they are usually not publicly traded companies and are less subject to public scrutiny.

They conclude:

The recent increase in primary credit borrowing from the DW may appear to be somewhat surprising, given the low and declining usage of the DW prior to the pandemic. We suggest that the lower rates and longer terms available under the primary credit program, combined with declining reserve balances in the banking system, have all contributed to this trend. It will be interesting to see whether this recent pattern in DW borrowing continues into the future or whether there is a return to the historical patten of DW borrowing.

The most intriguing implicit suggestion by the NY Fed’s economists is that the ample reserve regime is simply not quite as ample any more.